How much of a stock should be in your portfolio? Learn smart allocation rules, diversification strategies, and mistakes to avoid for safe investing.

You’ve found a stock you love. Maybe it’s Tata Motors after a strong quarter, HDFC Bank with its rock-solid reputation, or a buzzing small-cap everyone’s talking about. Now comes the big question:

👉 How much of this stock should you actually buy for your portfolio?

This is the part most beginners ignore. We spend hours researching which stock to buy, but almost no time thinking about how much weight it should carry in our portfolio. In fact, allocation often makes the difference between a resilient portfolio and one that crumbles after a bad quarter.

So, let’s break it down in simple, relatable terms.

Why Stock Allocation Matters More Than You Think

Imagine you’re making biryani. The rice is the base, but overload it with masala and oil, and the dish becomes overwhelming. Investing works the same way—too much exposure to one stock can overpower the balance.

- If a stock does well → you celebrate.

- If it tanks → your entire portfolio suffers.

This is why professional fund managers spend hours on allocation strategy—not just stock picking.

What You Should Remember

Good investing isn’t only about what you buy—it’s about how much you buy.

Rule of Thumb: The 5% to 10% Guideline

Most financial experts suggest no single stock should exceed 5–10% of your total portfolio.

- 5% Rule → Conservative investors. Keeps risk low.

- 10% Rule → Aggressive investors. Allows bigger bets, but with higher risk.

Example: If you have ₹10 lakh to invest, putting ₹1 lakh in Reliance (10%) is fine, but ₹4 lakh (40%) is dangerous—even if it feels “safe.”

Think of it like cricket batting—Virat Kohli may score centuries, but you still need other batsmen in the lineup.

What You Should Remember

Diversify like a cricket team. Even star players need support.

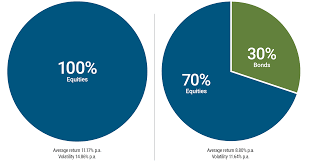

Diversification: The Shield Against Uncertainty

Markets are unpredictable. Even the best stocks face setbacks. That’s where diversification saves you.

- Mix large-caps (stability) with mid-caps (growth) and small-caps (high risk, high reward).

- Spread across sectors—banking, IT, pharma, FMCG, infra.

- Consider adding debt, gold, or index funds for balance.

It’s like building a thali meal—dal, sabzi, roti, and pickle. One dish can disappoint, but the plate still satisfies.

What You Should Remember

Don’t let one stock decide your financial future. Spread your bets.

The Risk Factor: How Much Can You Afford to Lose?

Before allocating, ask yourself: “If this stock falls 50%, will I lose sleep?”

- If yes → keep it small (2–3% of portfolio).

- If no → you can allocate more (5–10%).

Your risk appetite depends on age, income, goals, and emotional tolerance.

For a 28-year-old with a steady salary → higher risk is manageable.

For a 42-year-old with kids’ school fees → stability is priority.

What You Should Remember

Allocation isn’t just about math—it’s about psychology and personal comfort.

Sector Allocation: Don’t Put All Your Money in One Basket

Even if you diversify across stocks, don’t forget sector concentration risk.

Example:

- Buying HDFC Bank, SBI, and ICICI together may feel like diversification—but they’re all banking stocks.

- If RBI tightens policies, the whole sector can suffer.

Better mix: Banking (HDFC), IT (Infosys), Pharma (Sun Pharma), Auto (Tata Motors), FMCG (HUL).

Think of it as a movie cast—having three Khans may look glamorous, but what if action movies flop that year?

What You Should Remember

True diversification means across stocks + sectors + asset classes.

Mistakes Most Investors Make With Allocation

- Falling in love with one stock → Overweight position.

- Ignoring rebalancing → Portfolio drifts over time.

- Chasing news → Buying too much after hype.

- Copying others → Blindly following portfolios of friends or influencers.

One classic example is the 2008 Reliance Power IPO. Many retail investors put huge amounts into one stock, hoping for riches. The crash taught a painful lesson—allocation matters.

What You Should Remember

Mistakes happen, but allocation discipline prevents disasters.

Practical Steps to Decide Allocation

Here’s a simple framework:

- Define your portfolio size → e.g., ₹10 lakh.

- Set a max cap per stock → 5% rule = ₹50,000.

- Spread across 10–15 stocks → balanced exposure.

- Rebalance yearly → sell overweight, top up underweight.

- Align with goals → short-term vs long-term needs.

This is exactly what mutual funds do behind the scenes—but you can apply it personally too.

What You Should Remember

Allocation is not a one-time decision. It’s a living strategy.

Case Study: Two Investors, Two Outcomes

- Investor A: Put 50% of portfolio in one “hot” stock. It doubled in a year, then crashed 70%. Net loss: -35% overall.

- Investor B: Spread 10 stocks evenly at 10% each. Even with 2 stocks falling 40%, gains from others cushioned the blow. Net return: +15%.

The difference wasn’t stock-picking—it was allocation.

Conclusion: Balance Is Your Real Superpower

The stock market is full of noise—new highs, breaking news, hot tips. But allocation is the quiet hero that protects your money.

Whether you’re a first-time investor or a seasoned trader, remember: owning a stock is only half the game; deciding how much to own is the other half.

📣 Over to you—what’s your personal allocation style? Do you stick to the 5% rule, or do you sometimes take concentrated bets? Share your thoughts below.