New Excise Duty Regime: A Boost to Public Health or a Burden on Consumers?

The Indian government’s decision to raise taxes on cigarettes for the first time in nearly seven years has resulted in a substantial increase in cigarette prices. A pack of 10 sticks now costs at least Rs 22–25 more than before, with premium cigarettes of 76 mm length costing Rs 50–55 more per pack of 10 sticks, depending on the brand.

According to distributors, the increase in cigarette prices will vary depending on the length and type of cigarette. While manufacturers are yet to issue revised MRP declarations, distributors have begun billing old stock to retailers with 40% GST. Wholesale markets are expected to lift fresh stock with new MRPs from Monday onwards.

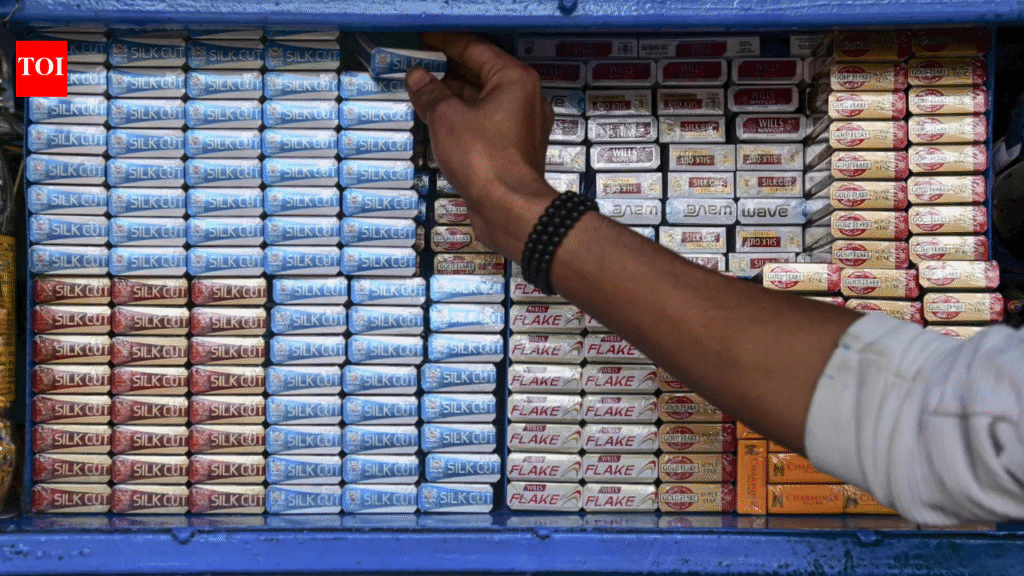

Price Hikes Across Various Cigarette Brands

A packet of Wills Navy Cut (76 mm), earlier priced at Rs 95 per pack of 10 sticks, is expected to cost around Rs 120 per pack. Cigarettes of 84 mm length—such as Gold Flake Kings and Lights, Wills Classic and Wills Classic Milds—currently priced at Rs 170 per pack of 10 sticks, are expected to cost between Rs 220 and Rs 225 per pack.

Slim cigarettes such as Classic Connect (97 mm), priced at Rs 300 for a pack of 20 sticks, are expected to have an MRP of around Rs 350. However, distributors fear that the price hikes could lead to increased smuggling and the spread of counterfeit products.

Impact on Small Retailers and the Economy

The All India Cigarette and Tobacco Distributors Federation (AICPDF) has expressed concerns that the price hikes could push small shopkeepers into the hands of illicit networks. With around 8,000–9,000 stockists of cigarettes and tobacco products across the country, the federation believes that this could lead to a significant loss of business for honest retailers.

From February 2026, cigarettes and tobacco products will attract additional excise duty and cess over and above the highest 40% GST slab, replacing the current structure of 28% GST plus compensation cess. The Central Excise Act has also been amended to impose a per-stick excise duty on cigarettes, with rates varying according to length.

Investor Implications and Market Trends

For investors looking to navigate the Indian stock market, it’s essential to stay informed about the latest developments in the tobacco industry. To learn more about Indian stock market trends and how to make informed investment decisions, visit our website.

Additionally, understanding the impact of taxation on various industries can help investors make more informed decisions. To learn more about taxation and investment, check out our resources on the topic.

Conclusion

In conclusion, the new excise duty regime has led to a significant increase in cigarette prices, with some packs now costing up to Rs 55 more. While this move aims to bring India’s tobacco taxation closer to global public health norms, it’s essential to consider the potential impact on small retailers and the economy.

As the Indian government continues to implement policies aimed at improving public health, it’s crucial for investors and consumers to stay informed about the latest developments. By staying up-to-date on the latest news and trends, individuals can make more informed decisions about their investments and lifestyle choices.